The stablecoin market reached $300+ billion in 2025. Within 18 months, enterprises will operate across 200 to 500 institutional stablecoins, each with distinct compliance requirements, yield opportunities, and operational workflows. For businesses managing payment infrastructure, treasury operations, or cross-border settlements, multi-stablecoin operations complexity is no longer a future concern. It's an immediate infrastructure challenge requiring strategic preparation.

Quick Answer: Managing multiple stablecoins requires orchestration infrastructure for acceptance, routing, yield optimization, compliance automation, and unified reporting. Companies building multi-stablecoin capabilities now gain 12-18 month competitive advantages over those still operating single-stablecoin systems.

Stablecoin Market Fragmentation: Current State in 2025

The stablecoin market structure is fragmenting faster than most businesses realize. While USDT ($184B market cap) and USDC ($60B+) dominate today's $300B total market, institutional stablecoin issuance is accelerating rapidly. Major banks, payment networks, and global corporations are launching proprietary stablecoins, creating a multi-stablecoin ecosystem that demands sophisticated operations infrastructure.

Major Institutional Stablecoin Launches

JPMorgan now processes $2 billion in daily transactions through Kinexys, its blockchain-based payment network. In June 2025, the bank launched JPMD (JPM Coin), a USD deposit token on the Base blockchain, marking the first time a major US bank brought deposit tokens to a public blockchain. Institutions including B2C2, Coinbase, and Mastercard have already completed transactions using this infrastructure.

PayPal's PYUSD has grown from $399 million to $775 million in early 2025 alone. The stablecoin now operates across multiple blockchains including Ethereum, Solana, and Stellar, with plans to reach 170+ countries. PayPal offers 4% annual rewards on PYUSD holdings, creating a compelling alternative to traditional deposits while expanding into working capital financing for small businesses.

Western Union launched its stablecoin initiative in October 2025, planning to issue USDPT on Solana in the first half of 2026. Built in partnership with Anchorage Digital Bank, USDPT will integrate with Western Union's Digital Asset Network, serving 150 million users across 200+ countries. The company specifically chose Solana after extensive evaluation for its reliability and scalability.

Beyond these headline players, a consortium of major international banks including Banco Santander, Bank of America, Barclays, BNP Paribas, Citi, Deutsche Bank, Goldman Sachs, MUFG, TD Bank Group, and UBS announced in October 2025 that they're jointly exploring stablecoin issuance focused on G7 currencies. This isn't a pilot project. It's infrastructure-building for the future financial system.

Stablecoin Market Data: 2025 Landscape

Understanding the current stablecoin market provides context for the complexity ahead:

Market Size & Growth:

Total market capitalization: $300 billion (November 2025)

Transaction volume 2024: $27.6 trillion (exceeding Visa + Mastercard combined by 7.68%)

Active stablecoin wallets: 30M+ (53% year-over-year growth)

Daily transfer volume: $20+ billion (USDT alone)

Blockchain Distribution:

Solana: Became most active network for stablecoin operations in 2024

Ethereum: Maintains 59.9% share by value, declining as alternatives grow

Multi-chain trend: Major stablecoins now deploy across 4-6 blockchains

Enterprise Adoption:

90% of financial institutions using or planning stablecoin integration

Cross-border remittances: 3% of $20 trillion annual market (2025)

B2B stablecoin flows: $36B annualized (2024)

Merchant acceptance: 25,000+ merchants globally (2025)

Regulatory Status:

12 countries enacted stablecoin-specific frameworks by mid-2025

GENIUS Act (US) effective January 2027

MiCA (EU) fully operational 2025

Singapore, Hong Kong, UAE frameworks active

This baseline helps quantify what changes when the market fragments 3-5x over 18 months.

Why Fragmentation Is Inevitable

Three converging forces make multi-stablecoin proliferation not just possible but inevitable.

Regulatory Clarity Unlocks Issuance

The GENIUS Act, signed into law on July 18, 2025, established the first federal regulatory framework for stablecoins in the United States. The legislation creates clear pathways for both federal and state-level stablecoin issuers, with explicit requirements for 100% reserve backing using US dollars or short-term Treasuries.

Here's what makes this transformative: banks can now issue stablecoins but cannot offer yield on them. This prohibition creates a structural opportunity for infrastructure providers while giving banks a clear path to stablecoin issuance. Similar frameworks have emerged globally. The EU's MiCA regulation took full effect in 2025. Hong Kong passed its Stablecoin Ordinance in May 2025, creating a licensing regime for fiat-referenced stablecoins. Singapore finalized its Single-Currency Stablecoin framework in 2023.

The regulatory green lights are illuminated. The question is no longer if institutions can issue stablecoins, but when.

Infrastructure Maturity Reduces Barriers

The technical barrier to stablecoin issuance has essentially collapsed. Companies like Paxos, Bridge (acquired by Stripe for $1.1 billion), and Anchorage Digital provide turnkey issuance infrastructure. What once required months of development now takes weeks or even days.

BNY Mellon launched a stablecoin reserve fund in November 2025 specifically to provide infrastructure for issuers to back their tokens. BlackRock's Circle Reserve Fund manages $66 billion in reserves backing USDC. These institutional-grade solutions make stablecoin issuance as straightforward as setting up a money market fund.

Blockchain infrastructure has evolved dramatically. Solana processes high transaction volumes at minimal cost. Ethereum Layer 2 solutions like Base offer sub-second, sub-cent settlement. Cross-chain bridges enable seamless value transfer between networks. The plumbing is ready for mass issuance.

Economic Incentives Are Compelling

The financial case for stablecoin issuance is straightforward. Stablecoin issuers hold reserves in US Treasuries yielding approximately 4% annually. For a $10 billion stablecoin, that's $400 million in annual revenue from reserves alone. Tether, the largest stablecoin issuer with $183 billion in circulation, generates substantial profits from this model.

For retailers like Walmart and Amazon, stablecoins offer a different value proposition: eliminating billions in credit card processing fees. The Federal Reserve found approximately $32 billion in interchange fees on prepaid and debit card transactions alone in 2021, a number growing rapidly. Stablecoins settle in seconds at fractions of a cent per transaction, compared to 2-3% for traditional card networks.

Corporate stablecoin economics work at scale. Amazon and Walmart reportedly explored stablecoin issuance in mid-2025, according to The Wall Street Journal. Other corporations including Expedia Group and major airlines have had similar discussions. The GENIUS Act's passage accelerated these plans, providing the regulatory certainty needed for corporate action.

Who's Already Issuing

The stablecoin issuer list extends far beyond crypto-native companies. Traditional financial institutions are moving aggressively into this space.

Société Générale's digital asset arm Forge issued EURCV in 2023 and announced plans in June 2025 to launch a dollar-backed stablecoin. The French banking giant is building both euro and dollar offerings to serve European and global markets.

Citigroup, JPMorgan (through Kinexys), and multiple other major banks have confirmed they're actively developing stablecoin infrastructure. Bank of America's CEO stated publicly that the bank could "imagine launching a bank stablecoin." Morgan Stanley's CEO expressed interest in working with regulators to serve as crypto transaction intermediaries.

MoneyGram launched instant USDC remittances in Colombia in 2025 through a partnership with Crossmint, demonstrating that traditional money transfer companies are embracing stablecoins for their core business.

Ripple launched RLUSD in December 2024 under New York's NYDFS charter. By September 2025, it reached $700 million market cap with partnerships including BlackRock and VanEck tokenized funds. The stablecoin targets institutional cross-border payments and has shown rapid institutional adoption.

PayPal's PYUSD expanded to Stellar in June 2025 alongside existing Ethereum and Solana deployments, specifically targeting cross-border payments and payment financing use cases in emerging markets. The multi-chain strategy reflects the reality that different blockchains serve different use cases and geographies.

Western Union's USDPT will leverage Solana's infrastructure to enable stablecoin-to-cash conversions through Rain, issuing Visa cards linked to stablecoins. The initiative includes "stable cards" for high-inflation economies like Argentina, where remittances can lose substantial value in weeks due to currency depreciation.

The Operations Nightmare

Now picture your business needing to operate across this fragmented landscape. The complexity multiplies with each new stablecoin.

Acceptance Complexity

Which stablecoins do you accept from customers? Do you support USDC, USDT, PYUSD, JPMD, USDPT, and dozens of others? How do you quote prices across multiple stablecoin denominations? What conversion rates do you offer between them?

Each stablecoin potentially trades at slightly different prices despite the 1:1 peg. USDC might trade at $1.0001 while USDT trades at $0.9998. These micro-spreads create pricing complexity for businesses accepting multiple stablecoins. Do you charge different prices based on the stablecoin used? How do you communicate this to customers?

User experience becomes a challenge. Customers need education on which stablecoins you accept and why. Payment flows need to handle multiple token types seamlessly. Checkout experiences must remain simple despite backend complexity.

Routing and Conversion Complexity

Which stablecoin is cheapest to settle in for any given transaction? Where do you hold operational buffers? How do you optimize for your counterparties' preferences?

Consider a payment flow: a customer pays in PYUSD on Solana, you need to pay a supplier who only accepts JPMD on Base, and you want to hold reserves in USDC on Ethereum for yield purposes. This single transaction requires:

Receiving PYUSD on Solana

Converting to a bridge-compatible asset

Moving value cross-chain

Converting to JPMD on Base for supplier payment

Separately managing USDC reserves for yield

Each step involves transaction fees, conversion spreads, timing considerations, and operational overhead. Manual management becomes impossible at scale.

Cross-chain routing adds another layer. Different blockchains have different fee structures, confirmation times, and finality characteristics. Ethereum Layer 1 offers maximum security but higher costs. Solana provides speed and low fees but requires different wallet infrastructure. Layer 2 solutions like Base offer middle ground but add complexity.

Yield Optimization Complexity

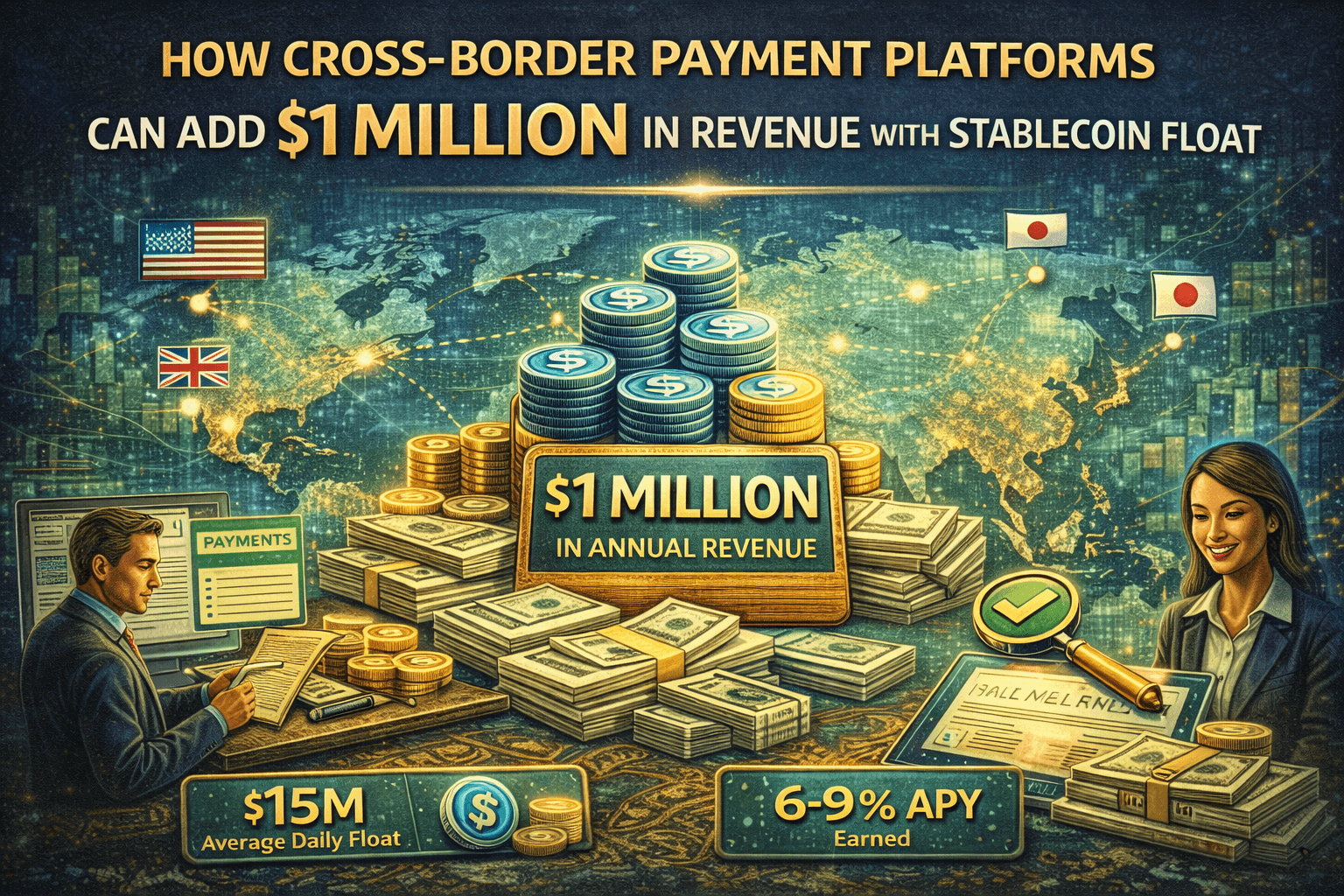

Different stablecoins offer different yield opportunities. PYUSD pays 4% directly to holders on PayPal. USDC can earn 6-9% through DeFi protocols on Solana. JPMD is interest-bearing with rates set by JPMorgan. Tokenized money market funds like BlackRock's BUIDL offer 5%+ yields with institutional oversight.

Your operations need systems to:

Track yield rates across multiple stablecoins and protocols

Calculate risk-adjusted returns considering smart contract risk, counterparty risk, and liquidity constraints

Automatically rebalance holdings to optimize yield while maintaining operational liquidity

Report yields accurately for accounting and tax purposes

The complexity scales with the number of stablecoins. Managing yield on three stablecoins is straightforward. Managing yield on twenty stablecoins across multiple chains and protocols requires sophisticated infrastructure.

Compliance and Regulatory Complexity

Each stablecoin potentially operates under different regulatory frameworks. USDC follows US money transmission laws. JPMD operates under banking regulations. International stablecoins might follow MiCA in the EU, Singapore's framework in Asia, or jurisdiction-specific rules elsewhere.

Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements vary by issuer. Some stablecoins have built-in compliance features. Others require separate compliance checks. The Travel Rule mandates sharing transaction information for transfers above certain thresholds, but implementation differs by blockchain and by jurisdiction.

Sanctions screening becomes more complex. Different blockchains have different address formats. Some addresses might be sanctioned on one chain but not flagged on another. Oracles and compliance services need integration across multiple protocols.

Tax and accounting treatment varies by stablecoin type. Are they treated as securities, commodities, or currency equivalents? The answer might differ by jurisdiction and by the specific stablecoin structure. Your systems need to track this for accurate financial reporting.

Reconciliation and Treasury Management

Traditional banking allows you to see all accounts in one dashboard, reconcile in one system, and manage liquidity holistically. Multi-stablecoin operations fragment this visibility across dozens of blockchains, wallets, and protocols.

You need infrastructure to:

Aggregate real-time balances across all stablecoins and chains

Reconcile blockchain transactions with internal ledgers

Forecast liquidity needs considering settlement times and conversion paths

Manage working capital efficiently despite fragmentation

Generate consolidated financial reports across disparate systems

The reconciliation challenge alone represents a significant operational burden. Blockchain transactions are instant and irreversible, but your internal systems operate on traditional accounting cycles. Matching these requires new processes and tools.

What This Means for Your Infrastructure

Current solutions weren't built for multi-stablecoin complexity. Treasury platforms optimize for static allocation, not dynamic operational flows. Custody platforms provide security but no yield or routing intelligence. DeFi protocols offer yield but lack enterprise-grade compliance and user experience.

The missing layer is orchestration infrastructure for multi-stablecoin operations. You need systems that can:

Accept any stablecoin from any chain without requiring users to understand blockchain nuances. The complexity should be hidden behind familiar payment experiences.

Route intelligently based on costs, speed, counterparty preferences, and regulatory requirements. Optimization should happen automatically without manual intervention.

Optimize yield continuously across all stablecoins and protocols while maintaining instant liquidity for operations. Capital should never sit idle, but should always be available when needed.

Handle compliance automatically, with built-in Travel Rule support, KYC/AML checks, and sanctions screening that works across all chains and stablecoins.

Provide unified visibility with consolidated dashboards, real-time reporting, and seamless integration with existing financial systems.

RebelFi is building this orchestration layer. Our infrastructure enables businesses to accept, convert, route, and optimize across multiple stablecoins without operational overhead. When a customer pays in PYUSD but your supplier needs JPMD, our system handles the conversion, routing, and compliance automatically. When you have idle USDC, we deploy it to yield-generating protocols while maintaining instant availability for operations.

The infrastructure isn't built yet for the multi-stablecoin world that's coming. But the companies building this infrastructure today will define how digital money flows tomorrow.

The Infrastructure Gap

Major financial institutions recognize this gap. Coinbase, Mastercard, and Stripe have collectively spent over $4 billion acquiring stablecoin infrastructure companies in 2025. Visa built its own global stablecoin settlement service. These moves aren't about handling today's three dominant stablecoins. They're about positioning for the 200-500 stablecoin future.

The rush to acquire infrastructure reflects a simple truth: the companies that control stablecoin orchestration will control the flow of digital liquidity. Just as Visa and Mastercard built empires on payment rail ownership, the next generation of financial infrastructure will be built on stablecoin orchestration.

But large acquisitions don't solve operational complexity for every business. Most companies can't afford billion-dollar infrastructure builds or acquisitions. They need platforms that aggregate this complexity, provide simple APIs, and handle multi-stablecoin operations seamlessly.

The infrastructure requirements include:

Multi-chain wallet infrastructure that handles dozens of blockchains

Automated liquidity management that optimizes across stablecoins and yields

Compliance engines that work across jurisdictions and regulations

Routing optimization that finds the cheapest, fastest path for any transaction

Unified reporting that consolidates activity for accounting and tax purposes

Building this internally takes years and millions in development costs. Most businesses will need to partner with infrastructure providers who solve these problems at the platform level.

Frequently Asked Questions: Multi-Stablecoin Operations

What is multi-stablecoin operations complexity?

Multi-stablecoin operations complexity refers to the infrastructure challenges businesses face when accepting, managing, and optimizing across multiple stablecoin types. This includes routing decisions, yield optimization, compliance requirements, and treasury management across 20+ different stablecoins with unique characteristics.

How many stablecoins will exist by 2027?

Industry projections estimate 200-500 institutional stablecoins by 2027, up from approximately 160 stablecoins in circulation as of 2024. Major issuers include JPMorgan (JPMD), PayPal (PYUSD), Western Union (USDPT), and banking consortiums across North America, Europe, and Asia.

Why are banks issuing their own stablecoins?

Banks issue stablecoins to capture treasury yield (4% on reserves), reduce payment processing costs, enable 24/7 settlement capabilities, and maintain competitive positioning as stablecoins become core financial infrastructure. The GENIUS Act (July 2025) provided regulatory clarity enabling bank stablecoin issuance.

What infrastructure is needed for multi-stablecoin operations?

Essential infrastructure includes: multi-chain wallet management, automated liquidity routing, yield optimization engines, compliance automation (KYC/AML/Travel Rule), cross-chain bridging capabilities, unified treasury reporting, and real-time balance aggregation across blockchains and stablecoin types.

How does stablecoin operations differ from treasury management?

Treasury management optimizes static capital allocation (where reserves sit). Stablecoin operations optimizes dynamic capital flows (how operational money moves). Different time horizons, liquidity needs, and optimization strategies require specialized infrastructure for operational vs treasury use cases.

The Opportunity

The chaos creates opportunity. First movers building for the multi-stablecoin future have a 12-18 month advantage over competitors still operating in a single-stablecoin world.

Operations infrastructure compounds. Each stablecoin integration makes your platform more valuable to customers who use that stablecoin. Network effects emerge when you can route payments efficiently between any two stablecoins. Partners who integrate with your infrastructure bring their own networks and use cases.

The companies prepared for stablecoin fragmentation will capture disproportionate market share. Those still building for a three-stablecoin world will face expensive, disruptive infrastructure overhauls when fragmentation accelerates.

Consider the economics: if you're processing $100 million in annual stablecoin flows today across three stablecoins, you might manage with manual processes and basic infrastructure. But when that grows to $500 million across twenty stablecoins, manual management breaks down completely. The infrastructure investment becomes mandatory, not optional.

Businesses that invest in multi-stablecoin infrastructure now will scale smoothly as the market fragments. Those that wait will face crisis-mode infrastructure builds while trying to maintain operations. The difference in execution quality, customer experience, and operational efficiency will be decisive.

The Institutional Wave Is Just Beginning

Standard Chartered predicts stablecoins will reach $750 billion market cap by the end of 2026, up from $300 billion today. J.P. Morgan's research suggests the market could reach $500-750 billion in the next couple of years with a more realistic scenario. Goldman Sachs sees the multi-stablecoin future as inevitable, with major financial institutions only waiting for regulatory clarity to deploy their solutions.

That clarity has arrived. The GENIUS Act in the US, MiCA in Europe, and similar frameworks globally provide the legal certainty institutions needed. The infrastructure is ready. The economic incentives are clear. The question is no longer if we get a multi-stablecoin world, but how quickly it arrives.

Wall Street Journal reports from June 2025 about Amazon, Walmart, and other major corporations exploring stablecoins aren't speculation. They're evidence that the world's largest companies recognize where payments infrastructure is heading. When retailers processing hundreds of billions in annual transactions explore stablecoin issuance, it signals a fundamental market shift.

The fragmentation will create winners and losers. Companies with flexible, sophisticated infrastructure will thrive. Those locked into single-stablecoin solutions or manual processes will struggle to adapt. Treasury operations that can optimize across dozens of stablecoins will outperform those stuck with static strategies.

For operations teams, product leaders, and treasury managers, the time to prepare is now. The infrastructure you build today determines your competitive position in 2027. The market is moving faster than most realize. By the time multi-stablecoin complexity becomes obvious to everyone, the infrastructure advantage will already be captured by early movers.

This is why stablecoin operations infrastructure matters. Not because of today's market, but because of the market that's inevitable. When businesses operate across 200 stablecoins instead of three, when every payment requires routing decisions and yield optimization, when compliance must work seamlessly across jurisdictions and protocols, the companies with proper infrastructure will win.

Stablecoin Operations Infrastructure: Next Steps

The multi-stablecoin future requires immediate infrastructure planning. Here's how forward-thinking enterprises are preparing:

Assessment Phase (30 days):

Audit current stablecoin touchpoints and volumes

Map acceptance, conversion, and settlement workflows

Identify yield opportunities in operational float

Calculate infrastructure investment requirements

Infrastructure Selection (60 days):

Evaluate orchestration platforms vs. build decisions

Assess multi-chain wallet and custody requirements

Review compliance automation capabilities

Plan integration with existing financial systems

Pilot Implementation (90 days):

Deploy multi-stablecoin acceptance on limited flows

Test routing and yield optimization logic

Validate compliance integrations

Measure operational efficiency improvements

Scale & Optimize (ongoing):

Expand to additional stablecoins as they launch

Refine yield optimization strategies

Automate more operational workflows

Build competitive moats through infrastructure advantages

The multi-stablecoin future isn't hypothetical. JPMorgan processes $2B daily through Kinexys. PayPal's PYUSD grew to $775M in months. Western Union launches USDPT in H1 2026. Amazon and Walmart explore stablecoin issuance. The infrastructure race is happening now.

Companies prepared for 200-500 stablecoins will execute seamlessly as fragmentation accelerates. Those assuming today's 3-stablecoin world continues will face crisis-mode infrastructure builds while trying to maintain operations. In financial infrastructure, preparation determines winners.

For payment operations, treasury management, and financial infrastructure leaders, the critical question is simple: is your infrastructure ready for the multi-stablecoin world that's already emerging?

About RebelFi: RebelFi builds programmable stablecoin infrastructure enabling businesses to accept, route, and optimize across multiple stablecoins without operational overhead. Our orchestration platform handles multi-chain operations, automated yield optimization, and compliance integration for the fragmented stablecoin landscape ahead.

Ready to prepare your operations for multi-stablecoin complexity? Schedule a consultation with RebelFi's infrastructure team →