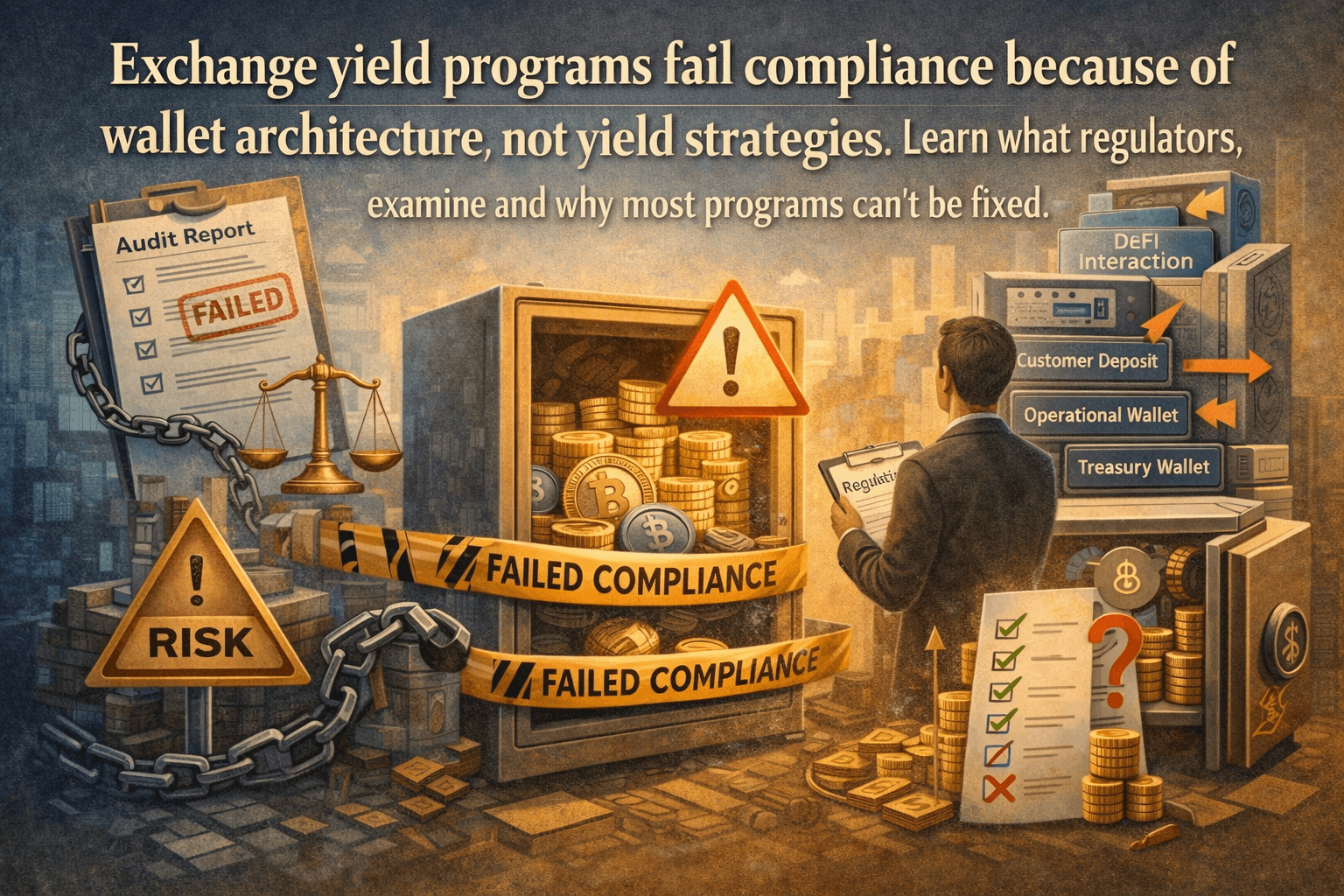

Exchange yield programs fail compliance reviews because of architecture, not yield strategies.

Regulators don't examine what happens after yield is generated. They examine how funds move before yield exists. If customer deposits touch DeFi directly, if treasury and customer funds share wallets, if there's no provenance chain, the program fails before it starts.

This matters in 2025-2026 because GENIUS Act and MiCA made these requirements law, not best practice.

What Is Exchange Yield Compliance?

Exchange yield compliance is the set of regulatory requirements exchanges must meet when offering yield to customers:

Fund segregation: Customer funds separate from treasury

Provenance tracking: Every dollar traceable from deposit to yield to withdrawal

KYT gates: Compliance checks at every fund movement, not just deposit

Securities classification: Product must not be an unregistered security

Custody separation: Clear legal ownership at every step

Most exchanges meet one or two. Compliance requires all five.

Why Do Exchange Yield Programs Fail?

Co-Mingling of Funds

The most common failure: customer deposits and treasury share wallet infrastructure.

When $100M in customer deposits and $20M in treasury sit in shared wallets, and the exchange deploys "idle funds" to yield strategies, regulators see custodial misuse. There's no proof which funds generated which yield, no liability separation if strategies fail.

The fix isn't documentation. It's separate wallets from day one.

No Internal KYT Screening

Most exchanges screen transactions at deposit and withdrawal only.

Compliant yield requires KYT at every internal transition: deposit → operations → settlement → treasury → yield strategy → back. Each step needs a compliance gate.

Without internal KYT, tainted funds flow through the entire system undetected.

Missing Provenance Chain

Exchanges can show: customer deposited X, withdrew Y, yield was Z.

They cannot show: which funds generated yield, what wallets handled them, whether funds touched high-risk sources.

Auditors cannot verify yield distributions without this chain.

What Are the Regulatory Issues With Crypto Yield?

GENIUS Act (US, 2025)

Stablecoin issuers cannot offer yield directly to holders

Yield must flow through intermediaries with custody separation

Regulators can demand proof of separation anytime

Exchanges passing through issuer reserve income are now non-compliant.

SEC Securities Test

Yield is likely a security if:

Yield is the primary value proposition

Users hold balances to earn returns

Exchange strategies create the yield

"Earn X% on deposits" positions yield as the product, failing the Howey test immediately.

MiCA (Europe)

Stablecoin issuers cannot pay interest. Yield on euro-backed stablecoins to EU customers is high-risk.

What Is Custodial Yield Risk?

Custodial yield risk is the exposure created when exchanges deploy customer funds for yield without safeguards:

Who absorbs losses if strategies fail?

Is the exchange an unregistered investment advisor?

Can positions unwind fast enough for withdrawals?

What happens if the yield source fails?

Customer consent doesn't solve this. Securities law doesn't care about consent. Custody obligations aren't waivable.

How Do Compliant Yield Programs Work?

Institutions that pass review (Coinbase, Anchorage, Fireblocks clients) use five-layer wallet segregation:

Layer | Function | Touches DeFi? |

Customer Deposits | Receive external transfers | Never |

Operations | Consolidate, first KYT | Never |

Settlement Buffer | Ring-fenced clean room | Never |

Treasury | Institution-owned only | Yes |

Protocol Wallets | One per DeFi protocol | Yes |

Key principle: Customer funds stop at Layer 3. Only treasury funds touch yield protocols. Yield flows back through the stack, gaining institutional provenance before reaching customers.

Customers receive funds from the exchange wallet, not from DeFi. The protocol origin becomes invisible.

Why Can't Existing Programs Be Fixed?

Building compliant infrastructure takes 12-24 months:

Wallet redesign: 3-6 months

KYT integration: 2-4 months

Legal structure: 3-6 months

Audit: 3-6 months

Regulatory approval: 3-12 months

Most exchanges are racing to rebuild while operating, hoping to finish before enforcement. Most will lose that race.

What Does Compliant Yield Infrastructure Require?

The compliant model separates generation from distribution:

Exchange deposits its own treasury into yield strategies

Exchange earns yield on its capital

Exchange distributes portion to customers as rewards

Customers never have exposure to yield sources. The exchange absorbs risk with its own capital.

This is how PayPal structures PYUSD rewards. This is how Paxos Global Dollar Network operates. Infrastructure providers like RebelFi build this as a layer because most exchanges cannot build it internally.

How to Know If Your Program Will Pass Review

Ask these questions:

Can you produce a fund flow diagram on demand?

Do you have KYT at every internal transition?

Are customer funds cryptographically separate from treasury?

Is your yield product classified as a security?

Can you prove which funds generated which yield?

If any answer is no, the program will not pass.