Most explanations of stablecoin infrastructure describe a clean three-layer stack: issuers at the bottom, ramps in the middle, and applications on top. That model is incomplete, it omits the layer where real businesses actually struggle: the operations layer that governs what happens to stablecoins once they arrive.

This gap exists because the stablecoin industry evolved from crypto trading infrastructure, not from financial operations. Issuers focused on minting and redeeming. Ramps focused on converting fiat. Custody focused on securing keys. Nobody built the plumbing for what businesses actually do with stablecoins between receipt and disbursement.

In 2026, that gap has become the binding constraint on adoption. The GENIUS Act in the United States and MiCA in Europe now require operational controls that existing infrastructure cannot provide. Companies holding operational stablecoins need wallet-level segregation, KYT enforcement, and audit-ready flows. None of that ships with your stablecoin issuer or custody provider.

What Is the Stablecoin Infrastructure Stack?

The stablecoin infrastructure stack refers to the layered set of services that enable businesses to hold, move, and use stablecoins. Each layer handles a specific function:

Layer | Primary Function | Examples |

Issuance | Creating and redeeming stablecoin tokens | Circle (USDC), Paxos (USDP, PYUSD), Tether |

Fiat Ramps | Converting between fiat currency and stablecoins | Bridge, BVNK, Zero Hash |

Custody | Securing private keys and authorizing transactions | Fireblocks, BitGo, Anchorage |

Operations | Governing how stablecoins behave in business workflows | Structurally missing in most deployments |

Application | End-user products and services | Payment apps, exchanges, neobanks |

The first three layers are mature. The operations layer is where most companies either improvise or fail.

What Does Each Layer Actually Do?

What Stablecoin Issuers Do

Issuers create the token itself. They maintain reserves, handle minting and redemption, publish attestations, and ensure 1:1 backing. Under the GENIUS Act, permitted issuers must hold reserves in high-quality liquid assets, publish monthly disclosures, and cannot offer yield directly on holdings.

What issuers do not do: manage how your business uses the tokens after you receive them. Once USDC hits your wallet, Circle's job is done.

What Fiat Ramps Do

Ramps convert value between traditional banking and blockchain. They handle bank account connections, ACH transfers, wire settlement, and the compliance associated with moving money across the fiat-crypto boundary. Bridge and BVNK excel here.

What ramps do not do: govern what happens to stablecoins after conversion. If you convert $10 million to USDC, the ramp does not manage where those funds sit, whether they earn yield, or how they move through your operations.

What Custody Providers Do

Custody providers secure private keys and enforce transaction signing policies. They offer multi-signature controls, role-based access, and audit trails for key usage. Fireblocks and BitGo are the standard bearers.

What custody providers do not do: manage fund flows, enforce business logic, or optimize capital. They protect keys. They do not govern operations.

What the Operations Layer Does

The operations layer governs how stablecoins behave inside business workflows. It sits between custody (which secures keys) and applications (which serve users). Operations infrastructure handles:

Fund Segregation: Separating customer funds from treasury funds from operational buffers. Regulatory frameworks now require wallet-level segregation that cannot be achieved through accounting alone.

Programmable Workflows: Conditional releases, milestone-based payments, time-locked transfers, multi-party escrow. These are table stakes in traditional finance but missing from most stablecoin deployments.

Yield on Operational Capital: Deploying idle funds to earn returns without breaking liquidity requirements or compliance constraints. This differs from treasury management because it applies to capital in motion, not static reserves.

Embedded Compliance: KYT checks at the transaction layer, tainted fund quarantine, Travel Rule metadata, and audit-ready state transitions. Compliance logic built into how funds move, not bolted on afterward.

Reversibility: Configurable cancellation windows for transfers. Traditional wires can be recalled. Basic stablecoin transfers cannot. The operations layer adds this capability.

Why Does This Gap Exist?

Three structural forces created this gap:

Origin in Trading Infrastructure: Stablecoin infrastructure emerged to serve crypto exchanges and trading desks. Those use cases require speed and finality, not operational complexity. The infrastructure reflects that history.

Custody-Centric Architecture: The industry organized around custody as the primary abstraction. Everything else became "something that happens after custody." This left operations as an undefined space.

Regulatory Lag: Until 2025, regulations did not require operational controls. Companies could hold stablecoins in single wallets, skip KYT, and ignore fund segregation. The GENIUS Act and MiCA changed that.

The result: issuers issue, ramps convert, custody secures, but nobody governs operations. Businesses improvise with spreadsheets, manual processes, and custom scripts.

How Does an Operations Layer Differ from Treasury Management?

Treasury management and stablecoin operations solve different problems for different buyers.

Dimension | Treasury Management | Stablecoin Operations |

Core question | Where should idle capital sit? | How should operational capital move? |

Primary buyer | CFO and Treasury teams | Payments, Ops, and Product teams |

Capital state | Static reserves | Dynamic flows |

Time horizon | Weeks to months | Hours to days |

Liquidity requirement | Periodic | Instant |

Key capability | Portfolio allocation | Programmable workflows |

Treasury management platforms like Kiln or traditional TMS systems optimize where reserves are allocated across yield venues. They assume capital is parked somewhere and needs periodic rebalancing.

Stablecoin operations infrastructure assumes capital is constantly moving. Payment floats, escrow holds, pre-funding buffers, settlement windows. These are operational states, not investment decisions. The capital must remain liquid, compliant, and productive simultaneously.

Companies need both. They are not substitutes.

What Happens Without an Operations Layer?

Without dedicated operations infrastructure, businesses face predictable failure modes:

Idle Capital Earns Zero: Operational stablecoins sit in custody earning nothing. A payment company with $10 million in pre-funding buffers loses $700,000 annually at 7% APY. That cost compounds.

Manual Compliance: KYT happens in separate systems, after transactions complete. Tainted funds mix with clean capital. Audit trails exist in spreadsheets. Regulators increasingly reject this approach.

No Reversibility: A payment sent to the wrong address is gone. Traditional payment rails include recall mechanisms. Basic stablecoin transfers do not. Without operations infrastructure, errors become permanent losses.

Fragmented Workflows: Escrow requires custom smart contracts. Conditional releases require manual intervention. Multi-party payments require coordination. Every workflow becomes a bespoke engineering project.

Regulatory Non-Compliance: The GENIUS Act requires fund segregation and operational controls. MiCA mandates similar standards. Companies without operations infrastructure cannot demonstrate compliance.

Who Needs an Operations Layer?

Three categories of businesses have acute need for operations infrastructure:

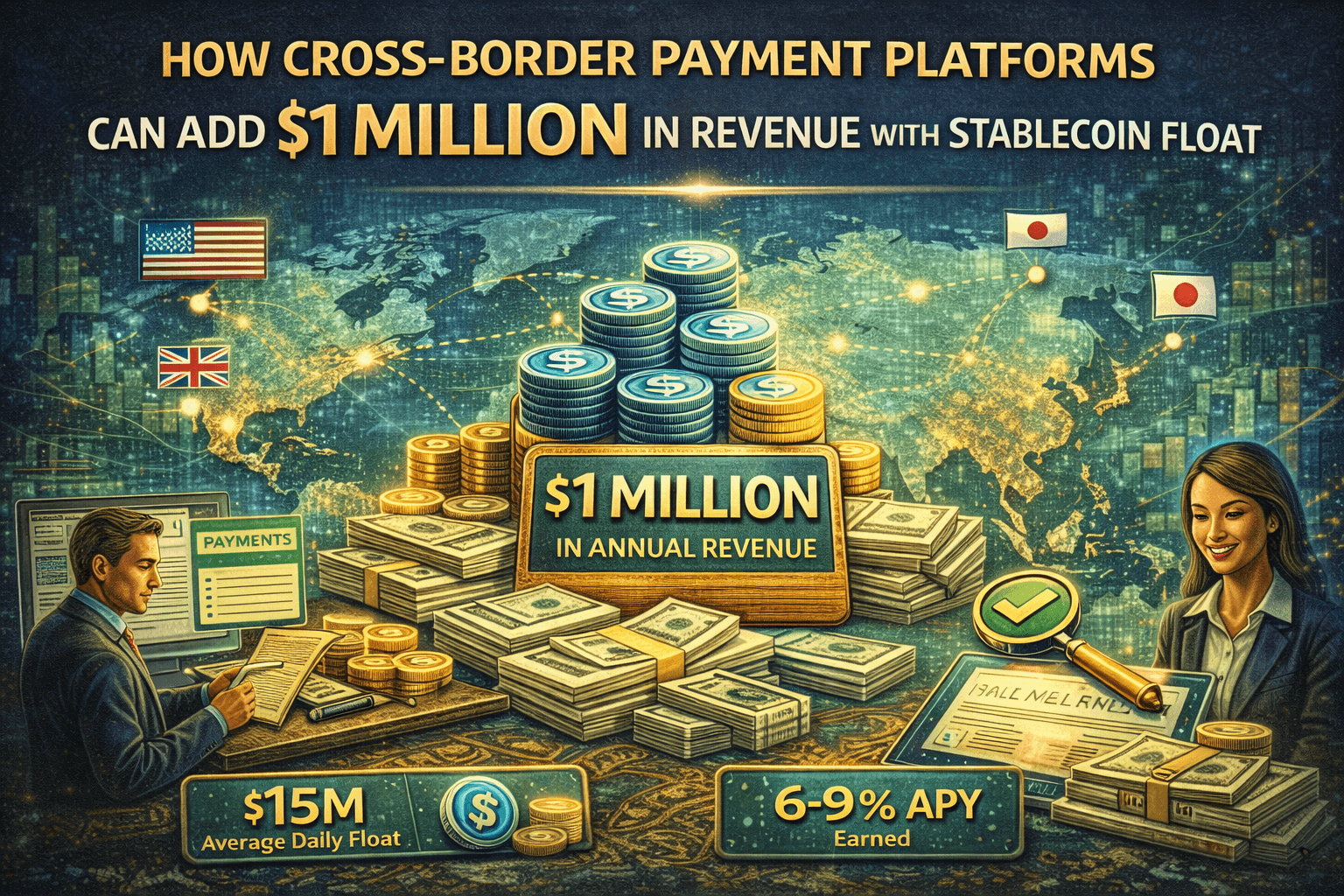

Payment and FX Platforms

Companies like cross-border payment providers hold significant pre-funding buffers. Capital sits in operational wallets between customer deposit and final payout. Without operations infrastructure, this capital earns zero while creating compliance exposure.

Operations infrastructure enables yield on float, reversible transfers, and compliant fund flows. For a payment company processing $100 million monthly, the difference between 0% and 7% yield on operational capital exceeds $500,000 annually.

Marketplaces and Gig Platforms

Platforms that hold funds between parties need escrow capabilities. A freelancer marketplace holds payment from client until work delivery. A property rental platform holds deposits during lease terms. A trade finance platform holds payment until shipping confirmation.

Operations infrastructure provides programmable escrow with conditional release, milestone-based payments, and dispute resolution workflows. These capabilities do not exist in basic stablecoin transfers.

Exchanges and Wallets

Custodial platforms hold customer funds that sit idle between trading activity. Regulations require segregation of customer and operational capital. Customers increasingly expect yield on idle balances.

Operations infrastructure enables compliant yield on customer deposits, segregated wallet architectures, and automated treasury management. The alternative is leaving billions in customer deposits earning nothing.

What Does Operations Layer Infrastructure Actually Include?

Operations infrastructure comprises three integrated capabilities:

Smart Account Architecture

Smart accounts are programmable wallets that enforce business logic at the account level. They differ from basic wallets in several ways:

Vault-Backed Accounts: Used for dedicated yield routing, full segregation, and treasury-style controls. Each account maintains independent state and policy.

Pooled Ledger Accounts: Used for high transaction velocity where internal transfers must be instant. Sub-ledger accounting enables shared yield optimization across many users.

Both models support role-based access, policy-driven routing, and audit-ready state transitions.

Programmable Transfers

Traditional stablecoin transfers are binary: sent or not sent. Operations infrastructure adds programmability:

Reversibility Windows: Transfers can be cancelled by the sender until claimed by the recipient. This mirrors traditional payment recall capabilities.

Conditional Release: Funds release based on time, milestones, oracle data, or multi-party approval. Escrow becomes infrastructure, not custom development.

Yield Continuity: Funds earn yield until final settlement. The transfer itself becomes productive.

Compliance Embedding: KYT checks and Travel Rule metadata travel with the transaction. Compliance is structural, not procedural.

Capital Efficiency Engine

Operational capital should be productive by default. The operations layer routes idle funds to yield sources while maintaining instant liquidity:

Yield Sources: On-chain liquidity markets, tokenized money market funds, delta-neutral strategies. The specific source matters less than the abstraction.

Liquidity Constraints: Yield deployment must not break operational requirements. If funds must be available in 30 seconds, yield strategies must accommodate that constraint.

Compliance Constraints: Yield cannot compromise regulatory standing. Ring-fenced architectures ensure customer funds and treasury funds follow different policies.

How Do Companies Implement Operations Infrastructure Today?

The market is early. Most companies improvise. A few approaches have emerged:

Custom Development: Large enterprises build proprietary operations infrastructure. This works but costs millions and takes years. JPMorgan's Kinexys is an example.

Cobbled Integrations: Companies stitch together custody providers, DeFi protocols, and custom scripts. This creates technical debt and compliance gaps.

Purpose-Built Infrastructure: A small number of providers now offer operations infrastructure as a product. RebelFi is one example, building smart accounts, programmable transfers, and yield infrastructure specifically for operational stablecoins. This approach offers faster deployment but requires trusting infrastructure partners.

The right approach depends on scale, technical capacity, and risk tolerance.

What Questions Should You Ask Before Building or Buying?

If evaluating operations infrastructure, these questions reveal capability gaps:

On Segregation: Can the system enforce wallet-level separation between customer funds, operational funds, and treasury reserves? Is segregation policy-driven or manual?

On Compliance: Does KYT happen at the transaction layer or in a separate system? Can tainted funds be automatically quarantined? Does the system support Travel Rule metadata?

On Yield: Can operational capital earn yield without breaking liquidity requirements? What happens if yield sources fail? Can different fund categories follow different yield policies?

On Programmability: Can transfers be cancelled before claim? Can escrow release be conditioned on external events? Can multi-party workflows execute atomically?

On Auditability: Does every state transition produce an audit trail? Can regulators inspect fund flows without accessing underlying systems?

Vendors who cannot answer these questions clearly do not have operations infrastructure. They have custody or ramps with extra features.

What Does This Mean for the Stablecoin Industry?

The emergence of a distinct operations layer signals maturity in stablecoin infrastructure. The industry is moving beyond "how do we move tokens" to "how do we run financial services on tokens."

This shift has three implications:

Regulatory Compliance Becomes Structural: Operations infrastructure embeds compliance into fund flows. This is what regulators expect. Bolt-on compliance will not satisfy the GENIUS Act or MiCA.

Capital Efficiency Becomes Default: Every idle dollar should earn yield. Operations infrastructure makes this automatic rather than optional. Companies without it face structural cost disadvantages.

Programmability Becomes Expected: Conditional payments, escrow, and reversibility become baseline capabilities. Applications will assume operations infrastructure exists, just as they assume custody exists today.

The companies building and deploying operations infrastructure now will define how stablecoins work in practice. The stack is incomplete without this layer. The market is correcting that gap.

Summary: The Four-Layer Stablecoin Stack

Layer | Function | What It Does Not Do |

Issuance | Creates and redeems tokens | Does not manage token usage |

Ramps | Converts between fiat and stablecoins | Does not govern post-conversion flows |

Custody | Secures keys and authorizes signing | Does not manage fund flows or business logic |

Operations | Governs how stablecoins behave in workflows | Does not issue tokens or secure keys |

The operations layer is the missing piece. It determines whether stablecoins become operational infrastructure or remain expensive settlement rails.