Most stablecoin operators learn about ring-fencing the hard way: after a compliance incident.

The pattern is consistent. A fintech processes stablecoin payments for months without issues. Then a KYT alert fires because an inbound transfer touched a flagged address three hops back. Suddenly, their exchange partner freezes the operational wallet. Not because the operator did anything wrong, but because their architecture couldn't prove they didn't.

The fix is always the same. Rebuild the wallet architecture from scratch. Segregate customer flows from treasury. Add KYT gates between layers. Create quarantine procedures.

This is ring-fencing. And in 2026, after the GENIUS Act formalized stablecoin compliance requirements, it's no longer a nice-to-have. It's table stakes for any operator touching institutional money.

What Is Ring-Fencing in Stablecoin Operations?

Ring-fencing is a multi-layer wallet architecture that isolates different types of capital flows from each other. The core principle: funds moving through one layer cannot contaminate another layer without passing through a compliance checkpoint.

In practice, this means:

Customer deposits never touch DeFi protocols directly

Protocol-origin funds never flow directly to customers

Treasury wallets only receive from verified internal sources

Flagged transactions route to quarantine, not operations

Each transition between wallet layers triggers a KYT check

The architecture exists because public blockchains have a fundamental property that creates compliance risk: anyone can send tokens to any address. A sanctioned entity can force-send USDC to your operational wallet without your consent. Without ring-fencing, that single inbound transaction can freeze your entire operation.

Ring-fencing solves this by treating taint as transactional, not address-level. The inbound transaction gets flagged and quarantined. The address stays clean. Operations continue.

Why Does Every Stablecoin Operator Eventually Rebuild This?

Three forces push every operator toward the same architecture.

Force 1: Exchange and banking partners require it: Coinbase, Kraken, and institutional OTC desks will not onboard stablecoin businesses without documented compliance architecture. They ask specific questions: How do you segregate customer funds? What's your quarantine procedure? How do you prove provenance on withdrawals? Without ring-fencing, you cannot answer these questions.

Force 2: Scale creates exposure: At low volume, compliance incidents are rare. At $10M monthly flow, you encounter edge cases weekly. A payment processor handling cross-border B2B might see a flagged transaction every few days. Without architectural isolation, each flag becomes an operational emergency.

Force 3: Regulatory clarity created enforcement expectations: The GENIUS Act, signed in July 2025, established federal requirements for stablecoin compliance. Regulators now expect documented procedures for handling tainted funds. "We manually review everything" is no longer an acceptable answer.

The rebuild happens because ad-hoc approaches collapse under these pressures. Operators try simpler solutions first: manual review queues, single-wallet operations with careful monitoring, post-hoc KYT checks. All of these break at scale. The architecture that survives looks remarkably similar across different operators because the underlying constraints are identical.

How Does Institutional Ring-Fencing Actually Work?

The canonical architecture used by Coinbase Institutional, Anchorage, Fireblocks clients, and major OTC desks is a five-layer wallet stack. Each layer has one purpose. Funds flow unidirectionally through the stack with KYT gates between layers.

Layer 1: Customer Deposit Addresses: One address per user or deposit. Public-facing, receives both tainted and clean flows. Heavy KYT screening. Never interacts with DeFi or yield protocols.

Layer 2: Operational Hot Wallets: Sweeps deposits, consolidates balances. First-pass KYT verification. Still not allowed to touch DeFi.

Layer 3: Settlement Buffer (Clean Room): First ring-fenced environment. Only receives from internal operations and approved custody. Outbound only to treasury. All inbound KYT-verified before movement.

Layer 4: Institutional Treasury Wallets: Holds institution-owned funds only. 100% provenance-clean. Never receives external inbound. Approved for DeFi interaction. This is the entry point to yield strategies.

Layer 5: DeFi Interaction Wallets: Protocol-specific. One wallet per protocol (Aave, Morpho, Kamino). Outbound only to protocol contracts and treasury wallets. Inbound only from protocol contracts and treasury wallets. Never interacts with customers. Never receives arbitrary external transfers.

The key insight: by the time funds reach Layer 5, the institution has complete provenance. When funds return from DeFi and eventually reach customers, the customer sees "Payment from [Institution] operational wallet." The DeFi interaction happened entirely within treasury operations, invisible to end users.

What Happens When You Skip Ring-Fencing?

The failure modes are predictable.

Wallet contamination: Without segregation, a single flagged inbound can trigger enhanced monitoring on your entire operational wallet. Some exchanges freeze accounts preemptively when they see mixed provenance. You lose access to your primary liquidity venue while resolving the issue.

Provenance disputes: When a compliance officer asks "where did these funds come from?", you need a clear answer. Mixed wallets produce answers like "some from customer deposits, some from yield, some we're not sure about." This is disqualifying for institutional relationships.

Quarantine paralysis: Without a quarantine procedure, flagged funds sit in operational wallets while you figure out what to do. Meanwhile, those funds are commingled with clean flows. The longer you wait, the harder it becomes to isolate the contamination.

Customer exposure: If customer payout wallets receive directly from DeFi protocols, your customers inherit that provenance. A customer receiving payment might find their own exchange account flagged because you routed through a yield protocol that pooled funds from unknown sources.

The common thread: problems that are manageable at small scale become operational crises at volume. The cost of rebuilding mid-operation exceeds the cost of building correctly upfront.

How Do Analytics Engines Classify DeFi Interactions?

A common misconception: interacting with DeFi protocols automatically taints your funds because protocols pool capital from unknown sources.

This misunderstands how KYT engines work. Analytics providers like Chainalysis, TRM Labs, and Elliptic classify DeFi interactions as "protocol interaction: low risk," not "received funds from unknown third party." The protocol is infrastructure, not a counterparty.

The risk model evaluates:

Did you interact with a sanctioned protocol? (Very few protocols are sanctioned)

Did you receive funds from a flagged address? (Protocol contracts are not flagged addresses)

Did your withdrawal contain specific tainted UTXOs or token flows? (Depends on protocol mechanics)

For lending protocols like Aave or Morpho, your deposit enters a pool and your withdrawal comes from the same pool. The pool is not a counterparty. It's more analogous to depositing at a bank than receiving a wire from an unknown sender.

This doesn't mean DeFi is risk-free. It means the risk model is more nuanced than "DeFi equals contamination."

What Is the Difference Between Address-Level and Transaction-Level Taint?

This distinction determines whether a compliance incident freezes your operations or gets isolated.

Address-level taint means any high-risk transaction touching an address contaminates the entire address. All future flows from that address inherit elevated risk. This model would make public blockchain operations impossible because anyone can send tokens to any address.

Transaction-level taint means only specific flows get flagged. The address receives a flagged inbound. That transaction routes to quarantine. The address continues normal operations. Future transactions are evaluated independently.

Modern KYT engines use transaction-level taint. This is why ring-fencing works: you can receive contaminated funds, quarantine them at the transaction level, and maintain clean operations on the same address.

The practical implication: unsolicited inbound transfers do not create liability. Moving those funds forward creates liability. Ring-fencing gives you the architecture to quarantine without forwarding.

Who Needs This Architecture?

Any organization where these conditions are true:

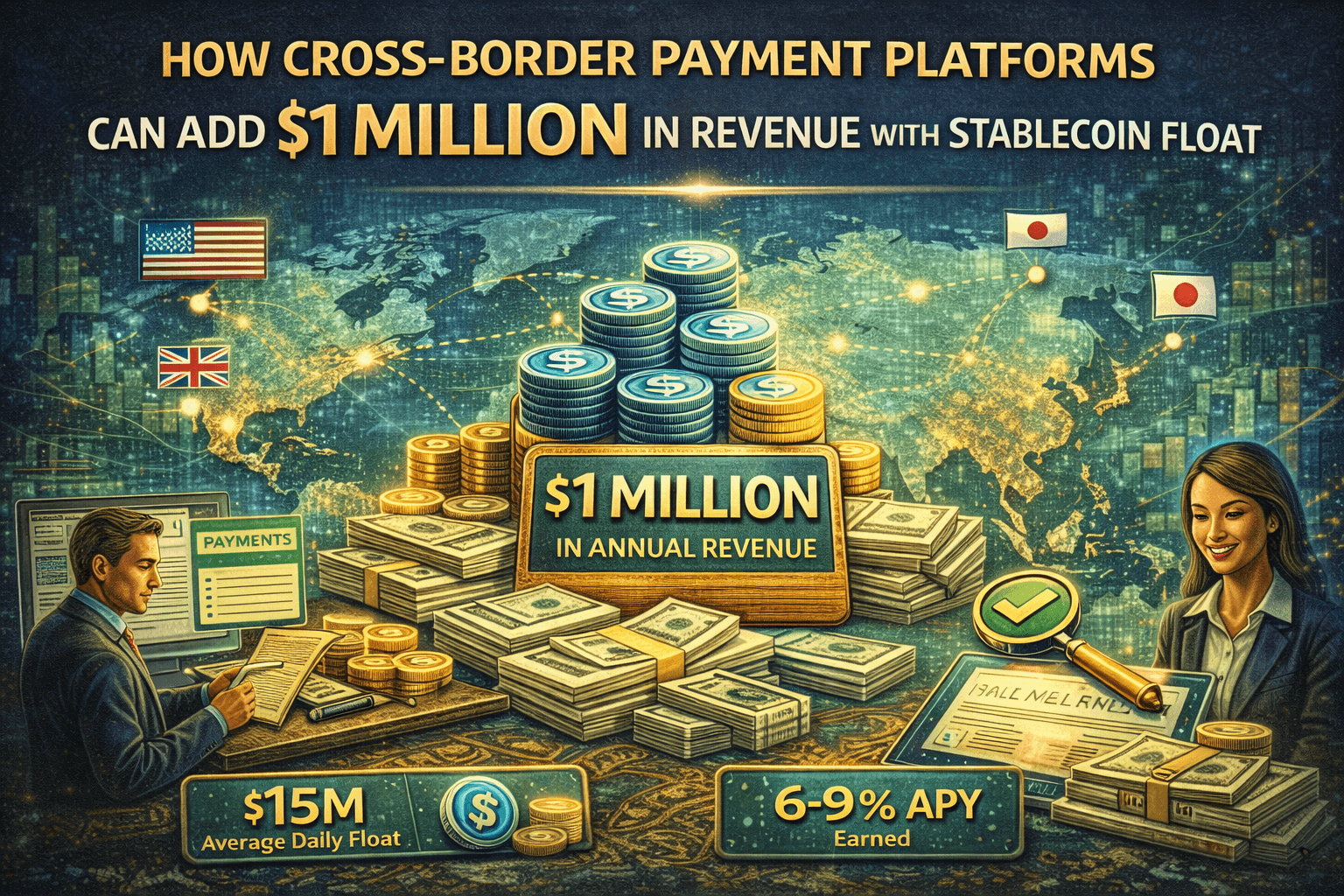

You process stablecoin volume exceeding $1M monthly

You need relationships with exchanges, banks, or institutional counterparties

You generate yield on operational capital or treasury holdings

Your customers include regulated entities

You operate in jurisdictions covered by GENIUS Act, MiCA, or equivalent frameworks

Specific operator types:

Payment processors handling cross-border B2B. Your customers are often businesses with their own compliance requirements. They need clean provenance on received funds.

Fintechs with stablecoin treasury. If you hold operational stablecoins and want to generate yield, you need ring-fencing to separate customer deposits from treasury operations.

Exchanges and OTC desks. Already doing this at the institutional level. Mid-market operators catching up.

Stablecoin issuers and infrastructure providers. Required for banking partnerships under GENIUS Act compliance frameworks.

How Do You Implement Ring-Fencing Without Rebuilding From Scratch?

The build-versus-buy decision depends on your volume and technical capacity.

Build internally if you have dedicated blockchain engineering, existing custody infrastructure you cannot change, and regulatory requirements for custom controls. Expect 3-6 months for initial implementation, ongoing maintenance, and the need to update as KYT providers evolve their APIs.

Use infrastructure providers if you need faster deployment, lack specialized blockchain compliance engineering, or want to avoid maintaining the architecture as regulations evolve. Several providers now offer ring-fencing as infrastructure, including RebelFi's programmable compliance layer, which handles wallet segregation, KYT gating, and quarantine routing through API integration rather than custom smart contract development.

Hybrid approaches are common. Use your existing custody provider for key management, integrate a KYT provider for transaction screening, and add an orchestration layer for automated routing between wallet tiers.

The implementation pattern:

Map your current flows: deposits, operations, treasury, payouts

Identify which flows touch DeFi or external protocols

Design wallet segregation that isolates those flows

Add KYT checkpoints between each wallet tier

Build quarantine procedures with manual review workflows

Document everything for compliance audits

What Are the Tradeoffs of Different Ring-Fencing Approaches?

More layers mean more latency: A five-layer architecture adds transaction time at each hop. For real-time payment use cases, this matters. Some operators compress to three layers: customer operations, treasury/yield, and quarantine. The tradeoff is less granular isolation.

Stricter KYT thresholds mean more false positives: Setting low risk tolerance catches more edge cases but creates more manual review. High-volume operators often use tiered thresholds: strict for customer payouts, moderate for internal transfers, baseline for treasury operations.

Protocol-specific wallets add operational complexity: Maintaining separate wallets for each DeFi protocol improves isolation but increases gas costs and management overhead. Some operators use aggregators instead, accepting marginally higher protocol risk for operational simplicity.

Full automation versus human review: Automated quarantine is faster but creates edge cases where legitimate funds get stuck. Manual review is thorough but doesn't scale. Most operators land on automated routing with human review for quarantine releases.

There's no universally correct configuration. The right architecture depends on your volume, risk tolerance, counterparty requirements, and operational capacity.

How Does On-Chain KYT Gating Work?

Traditional ring-fencing implements KYT checks off-chain. Funds move between wallets, then a separate system verifies the transaction and triggers alerts or quarantine if needed.

Emerging approaches embed KYT directly into smart contract logic. The escrow contract queries a KYT oracle before releasing funds. If the check passes, release proceeds. If it fails, funds route to quarantine automatically. The decision happens on-chain, in the same transaction, with an immutable audit trail.

This matters for programmable payment use cases. When you're building conditional escrow, milestone-based releases, or multi-party settlement, you want compliance checks integrated into the payment logic, not running in a parallel system that might lag or desync.

RebelFi's architecture implements this pattern: KYT verification embedded in the smart escrow contract, with automatic quarantine routing for flagged flows. The compliance decision travels with the payment.

What Does Ring-Fencing Look Like Under GENIUS Act Requirements?

The GENIUS Act, effective January 2027 (or 120 days after final regulations, whichever comes first), establishes federal requirements for stablecoin issuers. While ring-fencing architecture is not explicitly mandated, the compliance obligations effectively require it.

Relevant requirements:

Documented procedures for AML/KYC compliance

Ability to demonstrate reserve backing and fund segregation

Audit trails for all material transactions

Procedures for handling suspicious activity

For infrastructure providers and operators (not issuers), the implications flow through counterparty requirements. Banks and regulated entities will require documented compliance architecture from their stablecoin partners. Ring-fencing becomes a prerequisite for institutional relationships.

The three-year transition period for existing stablecoins means 2026 is the implementation window. Operators building ring-fencing now will be positioned for institutional partnerships as GENIUS Act enforcement begins.

What Questions Should You Ask Your Infrastructure Provider?

If you're evaluating ring-fencing infrastructure, these questions reveal architectural maturity:

How do you handle unsolicited inbound transfers to operational wallets?

Is taint tracked at the transaction level or address level?

What KYT providers do you integrate with, and how are thresholds configured?

How does quarantine routing work, and what's the release procedure?

Can I maintain custody with my existing provider, or do you require custody transfer?

How do you handle DeFi protocol interactions, and what's the provenance model for withdrawals?

What audit trails do you provide for compliance reporting?

The answers reveal whether the provider has actually implemented institutional-grade architecture or is offering a simplified version that will create problems at scale.

Summary: The Architecture That Survives

Ring-fencing converges to a similar pattern across operators because the underlying constraints are identical. Public blockchains allow arbitrary inbound transfers. KYT engines evaluate transaction-level risk. Institutional counterparties require provenance documentation. Regulatory frameworks expect documented procedures.

The architecture that survives:

Segregates customer operations from treasury operations

Uses KYT gates between wallet layers

Quarantines flagged transactions without contaminating addresses

Routes DeFi interactions through treasury-only wallets

Provides audit trails for every layer transition

Whether you build this internally, use infrastructure providers like RebelFi, or assemble from multiple vendors, the end state is the same. The only question is whether you build it proactively or rebuild it after a compliance incident.