The Core Problem Most People Miss

Institutional yield conversations focus on rates. This misses the point.

For regulated exchanges, the question is not "what yield can I get?" It is "can I prove where these funds came from?"

Yield provenance is the new constraint. An exchange earning 10% on funds is worthless if those funds become operationally toxic when they return to customer-facing wallets. One contaminated transaction can freeze an entire operational flow.

Regulators, banking partners, and auditors have shifted from asking "are you earning yield?" to "can you prove the yield is clean?"

The architecture that answers this question is called ring-fencing.

What Is Clean Yield in Crypto?

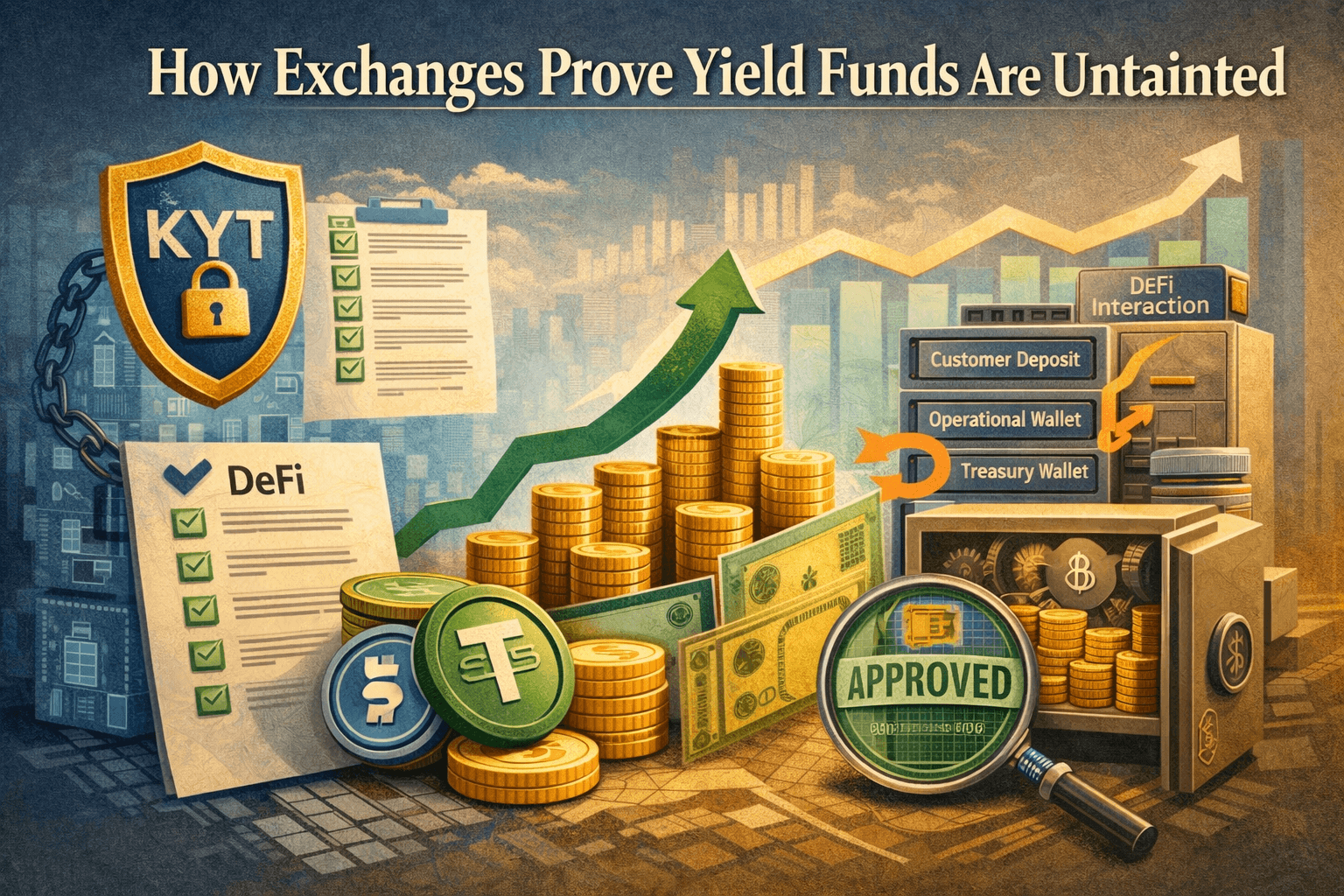

Clean yield refers to returns generated from sources with verified, auditable provenance that pass Know Your Transaction (KYT) screening at every stage.

The "clean" designation is not about the yield source itself. DeFi protocols like Aave or Morpho are not inherently dirty. The cleanliness comes from the operational architecture surrounding the yield generation.

Three conditions define clean yield crypto:

Segregated capital flows: Customer funds never touch yield-generating protocols. Only institution-owned treasury capital enters DeFi.

KYT-gated transitions: Every movement between wallet layers passes compliance screening before execution.

Reconstructed provenance: Funds returning from yield activities pass through compliant treasury wallets, breaking any external provenance chain before reaching customer operations.

Why Yield Provenance Matters More Than Yield Size

Consider two exchanges:

Exchange A earns 8% yield through properly ring-fenced architecture. Every transition is KYT-screened. Returns flow through institutional wallets before customer operations.

Exchange B earns 12% yield but sends funds directly to DeFi from operational wallets. Returns flow back to the same wallets used for customer withdrawals.

Exchange B has higher yield but existential risk. If any funds in the DeFi pool touched a sanctioned wallet or mixer, the exchange's operational wallets now have tainted provenance. Banking partners may freeze relationships.

The 4% yield difference becomes meaningless against operational shutdown risk.

How Ring-Fencing Works

Ring-fencing solves three compliance risks:

Arbitrary inbound transfers: Anyone can send USDC to a public address, including sanctioned entities. This cannot contaminate institutional operations.

DeFi protocol interactions: Protocols pool funds from anonymous wallets and high-risk sources. Institutions must ensure participation does not taint withdrawals.

Customer-to-DeFi contamination: Customer deposits must never end up in DeFi. Protocol returns must never flow directly to end-users.

The solution is strict wallet segregation with KYT gates between each layer.

The Institutional Wallet Architecture

Coinbase, Anchorage, and major OTC desks use a five-layer structure:

Layer | Purpose | DeFi Access |

L1: Customer Deposits | Receive user funds | Never |

L2: Operational Hot Wallets | Consolidate balances | Never |

L3: KYT Clean Room | Verify provenance | Never |

L4: Treasury Wallets | Institution-owned capital | Yes (entry point) |

L5: DeFi Wallets | Protocol-specific interaction | Yes |

Each layer has one purpose. Funds flow uni-directionally through the stack. KYT screening happens at every transition.

Critical insight: By the time funds reach customer payout wallets, they have passed multiple KYT checks and carry only institutional provenance. The customer sees "Payment from Exchange" not "Payment from Aave pool."

What Happens When Contamination Is Detected

Anyone can force-send USDC to any address. Institutions handle this through transaction-level isolation:

KYT triggers automatic alert on the inbound flow

Only that specific transaction is marked high-risk

Funds immediately route to quarantine wallet

The address itself remains clean

Key principle: Taint follows specific transactions, not addresses. One bad inbound does not contaminate the whole wallet.

This prevents the "$10 problem" where a small tainted transfer contaminates millions in operational capital.

Who Needs Compliant Treasury Wallets

Exchanges: Customer funds must remain segregated from treasury yield operations. Banking partners require demonstrable compliance architecture.

Payment processors: Settlement float represents yield opportunity, but contamination risk is unacceptable when funds route to merchant payouts.

Fintechs with stablecoin treasuries: GENIUS Act (US) and MiCA (EU) require wallet-level segregation and KYT-aware routing.

Infrastructure providers like RebelFi are building this architecture as turnkey infrastructure, transforming custom-built exchange systems into standardized, auditable rails.

The Market Shift

In 2023, institutional yield conversations centered on rate optimization.

In 2026, the conversation is: "Can you prove the provenance chain? Can auditors verify the architecture?"

Yield size is table stakes. Yield provenance is the competitive moat.

Institutions with proper ring-fencing access yield sources that remain off-limits to competitors without compliant infrastructure. Those without face a binary choice: zero yield on idle capital, or unquantified compliance risk.

Clean yield infrastructure is becoming the deciding factor.