Most people assume Islamic finance prohibits earning returns on capital. That's wrong. What Islamic finance prohibits is riba, which translates to interest but more precisely means "unearned increment" from a debt relationship. The distinction matters because it opens a practical path for Sharia-compliant businesses to generate yield on idle stablecoins and operational float.

The misunderstanding persists because conventional finance conflates all yield with interest. In traditional banking, if your money grows, someone paid you interest. But in on-chain finance, yield can come from entirely different sources: fees for providing a service, profit-sharing from real economic activity, or compensation for facilitating genuine trade.

This distinction became operationally relevant in 2025 because stablecoin adoption among Islamic finance institutions accelerated faster than compliant yield infrastructure. Companies now hold millions in USDC or USDT during settlement windows, earning nothing, because they assume all DeFi yield violates Sharia principles. That assumption costs them 4-8% annually on capital that could be productive without touching interest-based lending.

What Makes Yield Halal vs. Haram?

The core test is straightforward: Does the return come from a guaranteed debt obligation, or from participation in real economic activity with shared risk?

Haram (prohibited) yield:

Lending money and receiving a predetermined return regardless of outcome

Guaranteed interest payments from a borrower

Any structure where one party bears all risk while the other receives fixed compensation

Halal (permissible) yield:

Profit from facilitating genuine trade (ujrah, or service compensation)

Profit-sharing where both parties share gains and losses (mudarabah)

Returns from providing a necessary market function, where outcomes are uncertain

The practical application: If your capital is deployed into a lending protocol where borrowers pay interest, that's riba. If your capital is deployed into a liquidity pool where traders pay fees to execute swaps, that's service compensation.

How Liquidity Provision Generates Non-Interest Yield

Decentralized exchanges require liquidity to function. When a trader wants to swap USDC for USDT, someone needs to hold both assets in a pool to facilitate that trade. Liquidity providers deposit their stablecoins into these pools and receive a share of the trading fees generated when others use the pool.

The mechanism breaks down as follows:

Source 1: Trading fees. Every swap executed through the pool incurs a fee (typically 0.01-0.3%). This fee is distributed proportionally to liquidity providers. The fee compensates for a real service: making the trade possible.

Source 2: Protocol incentives. Some protocols distribute additional tokens to attract liquidity. These rewards function as promotional compensation, not interest.

The critical distinction: No borrower exists. No debt obligation exists. No guaranteed return exists. The provider shares in the pool's success or failure. If trading volume drops, returns drop. If the pool gets exploited, the provider loses capital. Risk is shared, which is the defining characteristic of Sharia-compliant finance.

Why This Structure Aligns With Islamic Finance Principles

Scholars and Islamic finance advisory bodies have evaluated liquidity provision models against core Sharia principles. The alignment is structural, not cosmetic.

No Riba: Returns come from transaction fees, not interest payments. There is no lender-borrower relationship. No one promises a fixed return.

Shared Risk (Gharar Mitigation): The liquidity provider's capital is exposed to pool dynamics. Returns fluctuate with trading volume. Smart contract exploits can cause losses. Both upside and downside are shared.

Real Economic Activity: Liquidity provision enables genuine commerce. Traders need to exchange assets for legitimate business purposes. The pool facilitates real transactions, not synthetic debt instruments.

Ujrah (Service Compensation): The fee structure compensates providers for a necessary market function. This mirrors traditional Islamic finance structures where compensation for services is permitted.

No Guaranteed Return: Expected yields of 4-8% are estimates based on historical trading volume, not contractual obligations. Actual returns vary daily based on market conditions.

Bodies like Shariyah Review Bureau, Islamic Finance Guru, and Practical Islamic Finance have referenced these principles when evaluating DeFi liquidity provision structures.

What Does Compliant Yield Look Like in Practice?

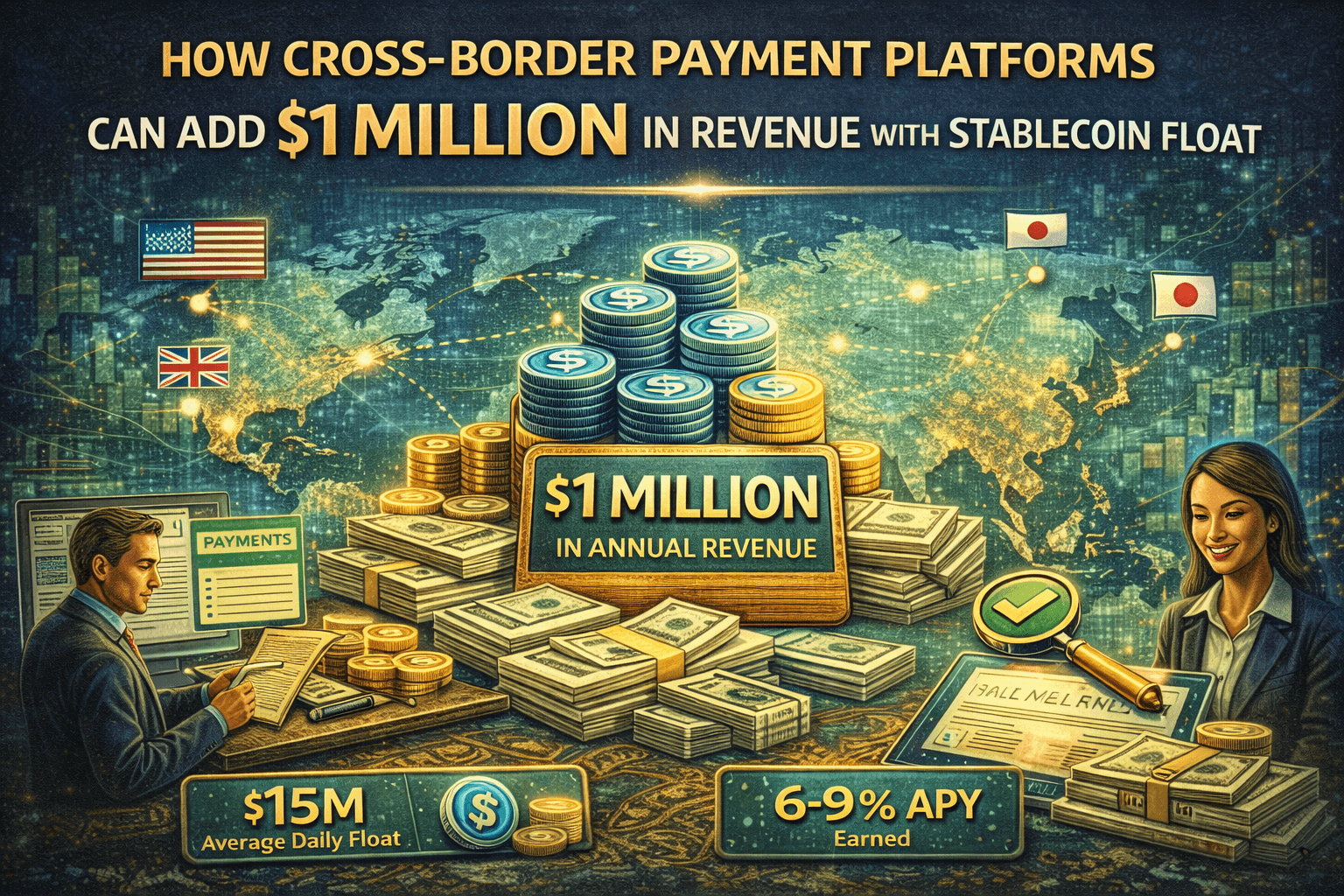

A payment company operating in an Islamic finance context holds $5 million in USDC during a three-day settlement window before disbursing to partners. Under conventional custody, this capital earns nothing.

With a Sharia-compliant liquidity provision structure:

The company deposits USDC into a stablecoin-to-stablecoin pool (USDC/USDT)

The pool facilitates swaps between traders

Traders pay fees on each swap

The company receives its proportional share of fees

Funds remain instantly withdrawable with no lockup period

The company maintains full custody and signing authority throughout

Expected economics:

Metric | Range |

Target annual yield | 4-6% |

Observed range | 3-8% |

Liquidity | Instant withdrawal |

Lockup period | None |

At $5 million deployed for three days, even conservative 4% annualized yield generates roughly $1,600 in that window. Over a year of similar settlement cycles, this compounds to $200,000+ in previously foregone returns.

Why Not Just Use Conventional DeFi Yield?

Most DeFi yield sources fail Sharia compliance tests because they rely on lending protocols. Aave, Compound, and similar platforms generate returns by lending deposited assets to borrowers who pay interest. The structure is functionally identical to conventional banking: lender provides capital, borrower pays predetermined rate, lender earns regardless of what borrower does with funds.

Liquidity provision on decentralized exchanges is structurally different:

Characteristic | Lending Protocols | Liquidity Provision |

Source of return | Interest from borrowers | Fees from traders |

Counterparty | Borrower with debt obligation | Traders executing swaps |

Risk profile | Credit risk on borrower | Market and smart contract risk |

Guaranteed return | Yes (APY is quoted) | No (depends on volume) |

Sharia status | Non-compliant (riba) | Compliant (ujrah) |

The distinction is not semantic. It reflects fundamentally different economic relationships.

Who Needs Sharia-Compliant Stablecoin Yield?

Payment companies and remittance providers operating in Muslim-majority markets. These companies hold operational float during settlement windows. Islamic finance principles may be required by regulation, customer expectation, or corporate policy.

Treasury operations at Islamic banks. Banks increasingly hold stablecoin reserves for cross-border settlement efficiency. These reserves sit idle under current structures because compliant yield infrastructure hasn't been available.

Fintech platforms serving Muslim customers. Neobanks and payment apps competing in markets like Indonesia, Malaysia, UAE, Saudi Arabia, Pakistan, and Turkey face customer demand for Sharia-compliant products. Offering halal yield on deposits becomes a competitive differentiator.

Islamic investment funds. Funds with Sharia mandates that have moved into digital assets need compliant ways to generate returns on stablecoin holdings between investment deployment.

Corporate treasuries with Islamic finance policies. Multinational companies operating in Islamic finance jurisdictions may maintain Sharia-compliant treasury policies as a matter of corporate governance.

What Are the Risks and How Are They Managed?

Sharia compliance doesn't eliminate risk. It structures risk to be shared rather than guaranteed away.

Smart contract risk: The pool operates on code. Bugs or exploits can cause losses. Mitigation: Use only protocols with extensive audit histories, $500M+ total value locked, and no prior exploit events.

Impermanent loss: In non-stablecoin pools, price movements between paired assets can reduce returns. Mitigation: Stablecoin-to-stablecoin pools (USDC/USDT) have minimal impermanent loss because both assets track the same value.

Protocol governance risk: Decentralized protocols can change parameters through governance votes. Mitigation: Monitor governance proposals and maintain ability to withdraw if parameters change unfavorably.

Regulatory risk: Jurisdictional rules on DeFi participation vary. Mitigation: Work with legal counsel to ensure compliance with local regulations in addition to Sharia principles.

Volume risk: Returns depend on trading activity. If volume drops, yields drop. This is not a bug, it's the feature that makes the structure compliant. Shared risk requires accepting variable returns.

How Infrastructure Providers Enable This

Operating a Sharia-compliant yield strategy requires specific capabilities:

Transaction orchestration without custody transfer: The operating company must retain full signing authority over its assets. Infrastructure providers like RebelFi orchestrate transactions without taking custody, meaning the company approves every deployment and withdrawal through its own wallet.

Whitelisted protocol access: Not every liquidity pool is appropriate. Infrastructure must restrict deployment to pre-approved pools meeting security and compliance criteria.

Instant liquidity maintenance: For operational float use cases, funds must be withdrawable immediately. The infrastructure must route to pools with sufficient depth to honor instant redemption.

Transparent fee attribution: Yield reporting must clearly show that returns come from trading fees, not interest. This documentation matters for Sharia audit purposes.

What This Means for 2026 and Beyond

Three trends make Sharia-compliant stablecoin yield increasingly relevant:

Regulatory clarity. The GENIUS Act in the US and MiCA in Europe have created clearer frameworks for stablecoin operations. Islamic finance jurisdictions are following with their own guidance. Compliant infrastructure now has a stable regulatory foundation.

Stablecoin adoption in Islamic finance markets. Cross-border payment volumes in MENA, Southeast Asia, and South Asia increasingly use stablecoins for efficiency. The companies processing these flows need yield solutions aligned with their operating principles.

Competition for idle capital. Conventional finance offers yield on deposits. Islamic finance institutions compete for customers who expect returns on their holdings. Compliant yield infrastructure closes the gap.

The companies building this infrastructure now establish relationships and operational track records before the market fully matures. First movers define the standards.

Summary

Islamic companies can earn yield without interest by deploying capital into liquidity provision structures where returns come from trading fees rather than lending. This aligns with Sharia principles because no debt relationship exists, risk is shared, returns are variable, and compensation is for a real service.

Practical implementation requires infrastructure that maintains custody with the operating company, restricts deployment to compliant pools, preserves instant liquidity, and documents fee attribution for audit purposes.

Expected yields of 4-8% on stablecoin holdings represent a material opportunity for payment companies, treasury operations, and financial institutions operating under Islamic finance mandates.